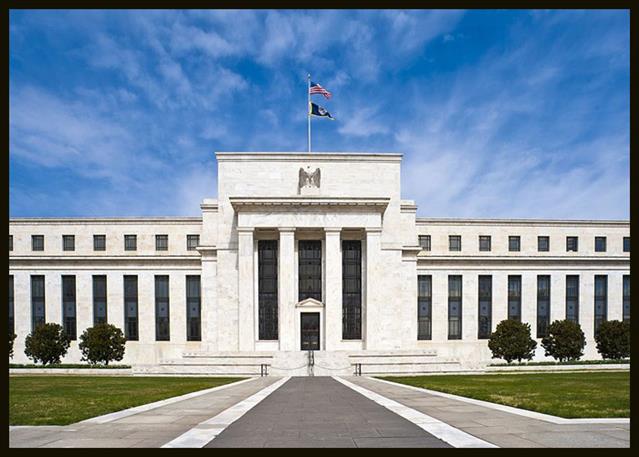

Recent data has not increased Federal Reserve officials’ confidence inflation is moving sustainably down to 2 percent, according to the minutes of the central bank’s latest monetary policy meeting.

Fed officials have repeatedly said they need greater confidence inflation is slowing before they consider cutting interest rates.

However, the minutes of the Fed’s March meeting noted the January and February readings on core and headline inflation had been firmer than expected.

Some participants noted the increases in inflation had been relatively broad based and therefore should not be discounted as merely statistical aberrations, the Fed said, although others noted residual seasonality could have affected the inflation readings at the start of the year.

Potentially adding to officials’ concerns, the Labor Department released a report Wednesday morning showing U.S. consumer prices once again increased more than expected in the month of March.

With regard to the outlook for inflation, the minutes said some participants pointed to geopolitical risks that might result in more severe supply bottlenecks or higher shipping costs that could put upward pressure on prices.

“The possibility that geopolitical events or surges in domestic demand could generate increased energy prices was also seen as an upside risk to inflation,” the Fed said.

The minutes revealed almost all participants still believe it will be appropriate to lower rates at some point this year but reiterated the need for greater confidence inflation is moving sustainably toward 2 percent.

Following the March 19-20 meeting, the Fed announced its widely expected decision to leave rates unchanged, although the central bank’s forecasts suggest rate cuts are still likely later this year.

In support of its dual goals of maximum employment and inflation at a rate of 2 percent over the longer run, the Fed said it once again decided to maintain the target range for the federal funds rate at 5.25 to 5.50 percent.

The target range for the federal funds rate has remained unchanged since the Fed raised rates by a quarter point last July.

Along with announcing the interest rate decision, Fed officials also provided updated projections for the economy and interest rates.

The latest projections suggest Fed officials expect rates to be lowered to a range of 4.50 to 4.75 percent by the end of 2024.

The interest rate forecast was unchanged from December and pointed to three quarter point rate cuts over the next nine months.

The Fed’s next monetary policy meeting is scheduled for April 30-May 1, with CME Group’s FedWatch Tool currently indicating a 95.4 percent chance rates will remain unchanged.

Copyright © 2024, RTTNews.com, Inc. All Rights Reserved.